Throughout this selective, two-year program based in our New York office, analysts will collaborate on projects with Bessemer partners across the globe and work with emerging founders and exceptional operators. While there are skills and lessons you can learn in school, many elements of venture capital, such as developing investment judgment, sourcing emerging new startups, and refining roadmaps for the future, are uniquely learned on the job by engaging with entrepreneurs and experienced investors. For almost twenty years, we’ve been fortunate enough to bring on three to four bright, ambitious, and aspiring investors each year to join the program as a foray into their careers. “The amount of responsibility that we are able to give junior folks, they can get the same amount of experience in two years as they would somewhere else in five or six,” he says.At Bessemer, we believe venture capital thrives in an apprenticeship model. Parekh says “that’s the big question I stay up to think about,” but the investor argues that his firm’s velocity of deals makes it an attractive place to work even as it requires processes to handle such complex funds. Insight’s greatest challenge with such large funds instead may be the temptation to add more bureaucracy to a staff already large enough to make it popular with other firms looking to poach talent. “But we also take seriously the ability to deliver the value-add that we have to all of them.” “We will have a larger number of portfolio companies than some,” says Parekh. Insight has also kept its check sizes roughly consistent, the investor adds. But with companies remaining private and not necessarily generating liquidity to investors who poured large sums into its funds, NEA is reported to be setting up a separate fund to buy shares in its own portfolio, in part to give liquidity to its main fund’s investors.Īt Insight, Parekh says that relatively consistent exits across the firm’s venture and buyout portfolios have meant that the firm hasn’t sold secondary shares in its investments to date. Decades-old stalwart NEA raised $3.3 billion in June 2017, slightly bigger than another raised in 2015. īut such large funds can come with complications. Insight Venture Partners’ leaders are the biggest investors in its new record-sized fund. Even bigger, Sequoia Capital raised a $6 billion growth fund in April that reportedly could swell to $8 billion. Index Ventures raised $1.65 billion earlier in July, while IVP announced a $1.5 billion fund last September. Hanging over the entire industry is Softbank’s $100 billion Vision Fund, but traditional name-brand firms have increased their fund sizes as well. Its $6.3 billion fund is one of the larger in a wave of billion-plus funds announced in recent months.

Insight venture partners full time application software#

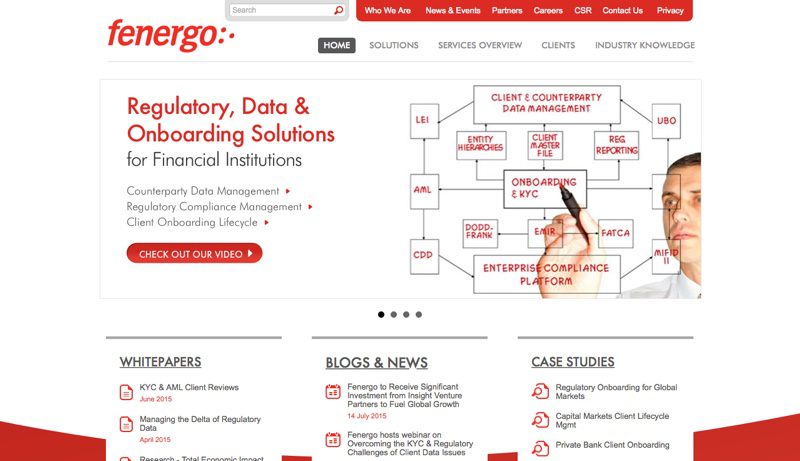

Insight’s currently invested in more than 150 software companies, having exited more than 225 by acquisition and more than 40 by IPO over the years, the firm says. Insight is known in the venture capital industry for its relatively large team of operational and investment professionals who support its partners and portfolio companies, including a team called “Insight Onsite,” which provides in-house sales, staffing and consulting support to the portfolio.

Pluralsight and Smartsheet, two recent portfolio initial public offerings, both initially took smaller venture checks from the firm, he says.

According to Parekh, Insight’s ability to continue raising larger funds is in part due to a strategy of concentrating behind emerging winners in the portfolio. Larger-size firms come with their own pressures to generate corresponding cash returns.

0 kommentar(er)

0 kommentar(er)